Blog by Silvia Bujor

Oracle Intelligent Advisor and its Industry Use Cases

7 min read

Author: Luis Figueira

6 min read

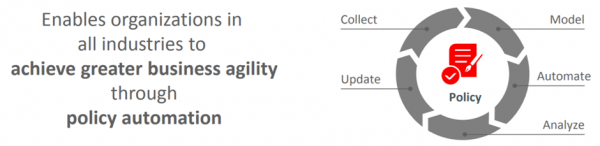

It’s comes as no surprise to Boxfusion that, in the age of accelerated digital transformation and heightened customer experience (CX), Oracle Policy Automation (OPA) is quickly becoming a new industry standard. This is because businesses are realising the full potential of a well-integrated end-to-end solution for capturing, managing, and deploying document-based policies across channels and processes.

For us, OPA integration has always been an important aspect of our strategy and we’ve been lucky enough to work alongside several businesses to implement bespoke OPA solutions that meet their unique business challenges.

Most recently, we completed a very interesting project where OPA was used to allow a large utilities firm to reduce their processing time and increase their regulatory compliance. For me, this is a great opportunity to reflect on the real benefits of OPA and how, if integrated well, it can be leveraged across both Service and Sales in any digital transformation strategy.

OPA is a product that Oracle acquired around 2008-2009 and, while historically very powerful as either a standalone product or when integrated with Siebel, it has since found its new home in the Oracle Service Cloud family (see below).

OPA was designed for - and is ideally positioned in - scenarios where legislation or policy documents need to be taken into executable business rules, particularly for the calculation of benefit entitlements and payment amounts (the image below llustrates the complete OPA process cycle). This makes it particularly well-suited in a public sector environment--in fact, the majority of clients for whom we have delivered OPA integrations currently reside within the public sector space.

Generally, across all industry sectors, OPA is ideal for organisations looking to make more information available to customers and potential customers through interactive online advice tools. It’s also great in providing dynamic advice which it generates in natural language. This can significantly reduce the cost of providing this type of service to customers and can increase the trust customers have in brands by providing consistent and clearly-worded results.

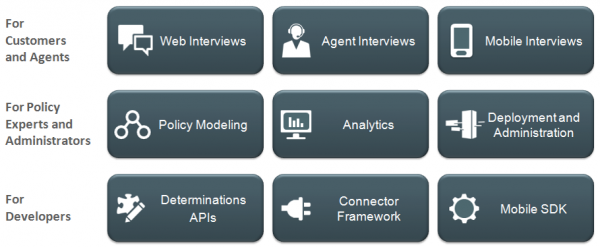

OPA currently resides within the Oracle Service Cloud family of Cloud Services, but this does not mean that OPA is used only with Service Cloud. Although we have delivered a number of projects where OPA is used for end-customer and agent interviews in Oracle Service Cloud, there is a vast potential set of CX scenarios where OPA can be a key piece of the architecture. Indeed, another obvious area where OPA can be used is with Sales / Engagement Cloud (see below).

OPA is best used integrated with other CX applications. For example, it comes packaged with pre-built connectors for Service Cloud, significantly reducing the time and complexity of integration of the two tools. More recently, these pre-built connectors have been included in Oracle Sales Cloud verticals, most notably the financial services vertical. The main difference is that the Sales Cloud verticals come packaged with an OPA hub with limited usage thresholds, whereas the generic Sales Cloud pods do not come packaged with an OPA hub.

OPA can be used in many different ways within a world-class digital architecture. Given its strength in policy-driven environments, here’s a few ideas where OPA can be leveraged to benefit the business.

The most typical scenario will be to use OPA integrated with Service Cloud. Who hasn’t groaned while filling out a form requesting data that they know they’ve submitted before? By bringing in data about a customer from Service Cloud that informs decisions and helps users complete those forms we can make the experience as seamless and positive as possible for customers.

On the other hand, OPA can be used internally to aid in complex business processes or cater to significant policy demands. For example:

The main driver for choosing OPA as a solution for the above examples is cost reduction, in terms of time and effort organisations spend providing world-class Customer Service operations, and in compliance, enforcement and auditing of policies.

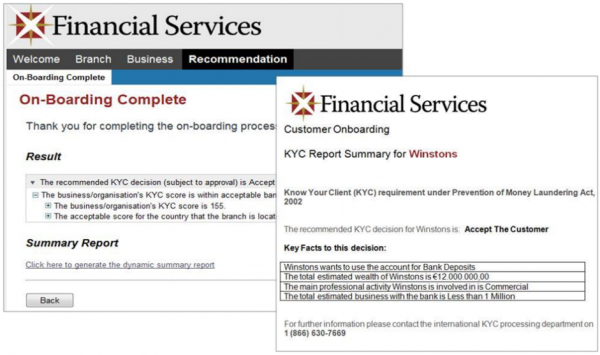

OPA integrated with Sales Cloud opens up a different set of possibilities, especially for businesses that sit within the financial services sector (insurance firms, retail banks and consumer banks for example). In a Customer Service setting, the focus is on providing help through a challenging situation and trying to make is as positive as possible for the customer. In a Sales setting, however, the challenge is most often to make an onboarding (see image just above) or product acquisition experience as easy as possible. Here are some examples:

Some of the benefits of OPA in the above scenarios are clearly linked to cost reductions, as in the case with the Customer Service scenarios. However, here, especially in the financial sector, other cost savings can be estimated based on regulatory compliance risk or financial exposure risk and OPA’s ability to reduce these risks.

Furthermore, there are some possibilities for value-add. This can come in the form of increased likelihood of cross-sell/up-sell options via timely product recommendations, or acquiring more customers by providing stellar onboarding experiences, for example.

It’s no surprise that we’ve seen a steady increase in investment into OPA from our clients. As we can see from the scenarios mentioned above, the benefits are far-reaching for both Service and increasingly Sales. In the case of the many Customer Service scenarios where OPA can be leveraged, the key benefits are clearly linked to cost reductions. On the Sales side (especially in the financial sector as we’ve explored), OPA provides the ideal platform to up-sell/cross-sell products, generate branded, professional documentation for customer and prospects, and enhance the customer onboarding process. In addition, OPA for Sales allows financial services companies the real flexibility they need to adapt to ever-changing regulation.

In all cases we’ve seen OPA being used, it has certainly demonstrated itself to be a promising addition to many firms’ technology solutions as part of the digital transformation movement.

7 min read

7 min read

The November 2016 OPA release has opened up new doors to enhanced user experience...

7 min read